An Enterprise Resource Planning (ERP) implementation is one of the most significant investments a growing business can make. When done right, it becomes the central nervous system of your operation, providing clarity, control, and a scalable platform for future growth. When done wrong, it can lead to catastrophic data errors, crippling operational inefficiencies, and costly rework.

The single most common point of failure is a weak foundation. In Odoo, that foundation is the Fiscal Localisation Package.

Many technical implementers treat this as a simple checkbox—a minor setting to be configured before moving on to more complex modules. From an accountant's perspective, this is a critical mistake. Getting the localisation right from the very beginning is the most important step in de-risking your entire project. It is the cornerstone upon which every transaction, report, and financial statement will be built. Getting it wrong is not an option because once transactions are posted, this fundamental setting cannot be changed.

This chapter will explain what the Australian localisation package is, what it includes, and why ensuring it is configured correctly by a finance-first expert is essential for the integrity of your business data.

What is Odoo Fiscal Localisation? A Compliance Package, Not Just a Setting

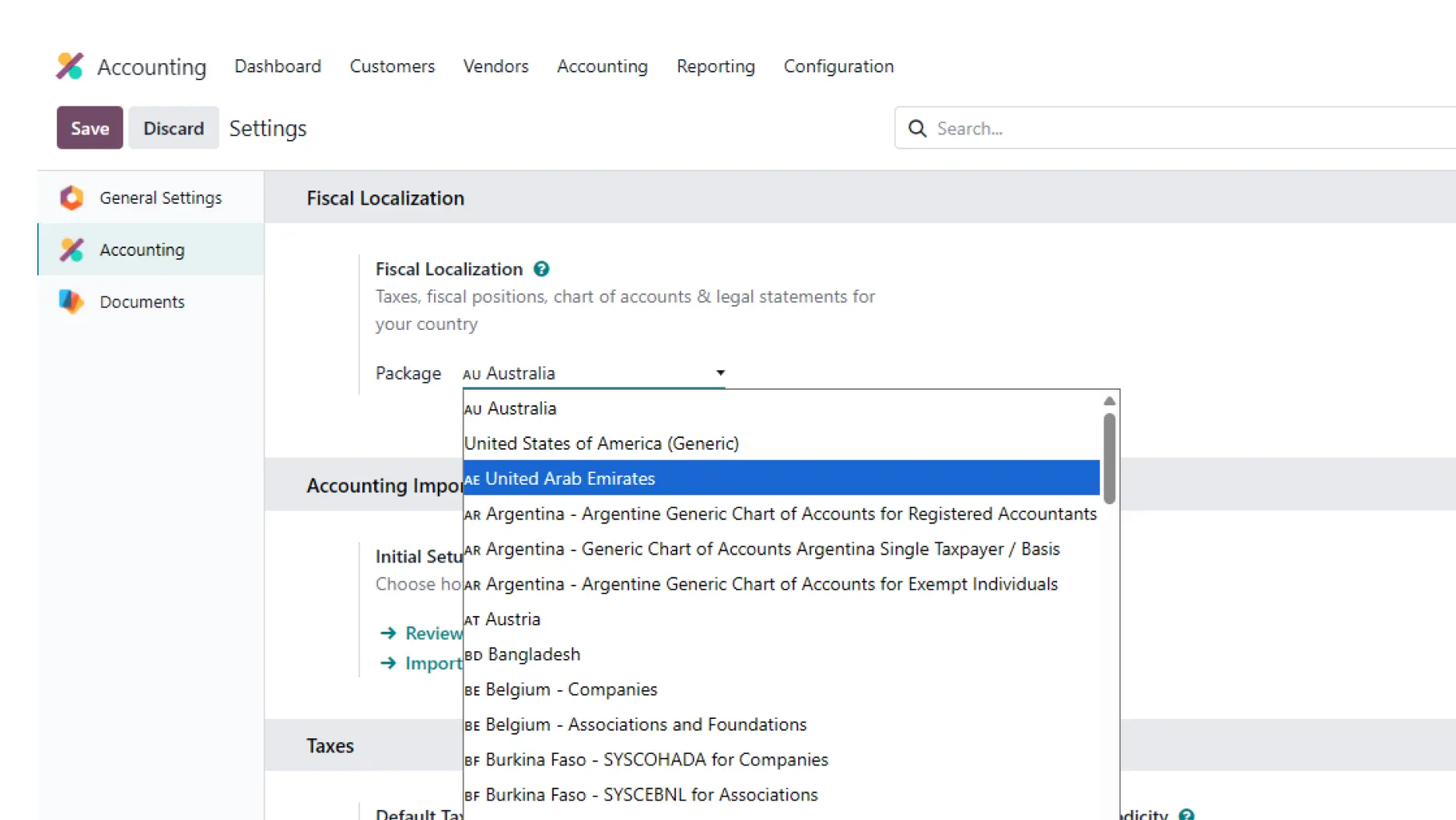

Odoo's fiscal localisation is a country-specific compliance and configuration package designed to ensure your accounting system adheres to a nation's specific financial regulations from the moment your database is created. Odoo offers these packages for over 100 countries, automatically configuring the system to handle local tax laws, reporting standards, and common financial practices

When the Australian localisation is activated, it does more than just set your currency to AUD. It installs a suite of pre-configured financial tools and settings that are essential for any Australian business, including :

- An Australian-compliant Chart of Accounts (CoA).

- Correct Goods and Services Tax (GST) rates, rules, and tax reporting structures.

- Country-specific financial reports, most notably the Business Activity Statement (BAS) and Taxable Payments Annual Report (TPAR).

- Modules for Australian-specific banking processes, like generating ABA files for batch payments.

- Australia Payroll, the Base payroll module for the Australian Localisation which includes employee taxation details (TFN, tax free thresholds, residency, super and STP) & Keypay Integration.

- Peppol E- Invoicing - Supports formatting and exporting invoices and credit notes in A‑NZ PEPPOL BIS Billing 3.0 compliant formats for electronic document exchange.

A Deep Dive into the Australian Localisation Package

The Australian localisation package is meticulously designed to handle the nuances of the Australian Tax Office (ATO) requirements. Here’s what matters most for your business:

1. An ATO-Compliant Chart of Accounts (CoA)

Instead of forcing you to build a CoA from scratch—a process fraught with risk for non-accountants—Odoo provides a standard, robust set of 116 accounts tailored for Australian businesses. This includes the essential accounts for tracking GST Paid and GST Collected, stock valuation clearing accounts, and foreign currency exchange differences, providing a solid framework for accurate financial recording.

2. Pre-configured Goods and Services Tax (GST)

The package automatically creates the necessary tax rates and rules to correctly manage GST. This includes the standard 10% GST for sales and purchases, as well as specific codes for GST-free sales, exports, and capital purchases. Crucially, each tax code is pre-mapped to the correct general ledger accounts, ensuring that every time a tax is applied to an invoice or bill, the financial impact is recorded accurately and flows through to your BAS report without manual intervention.

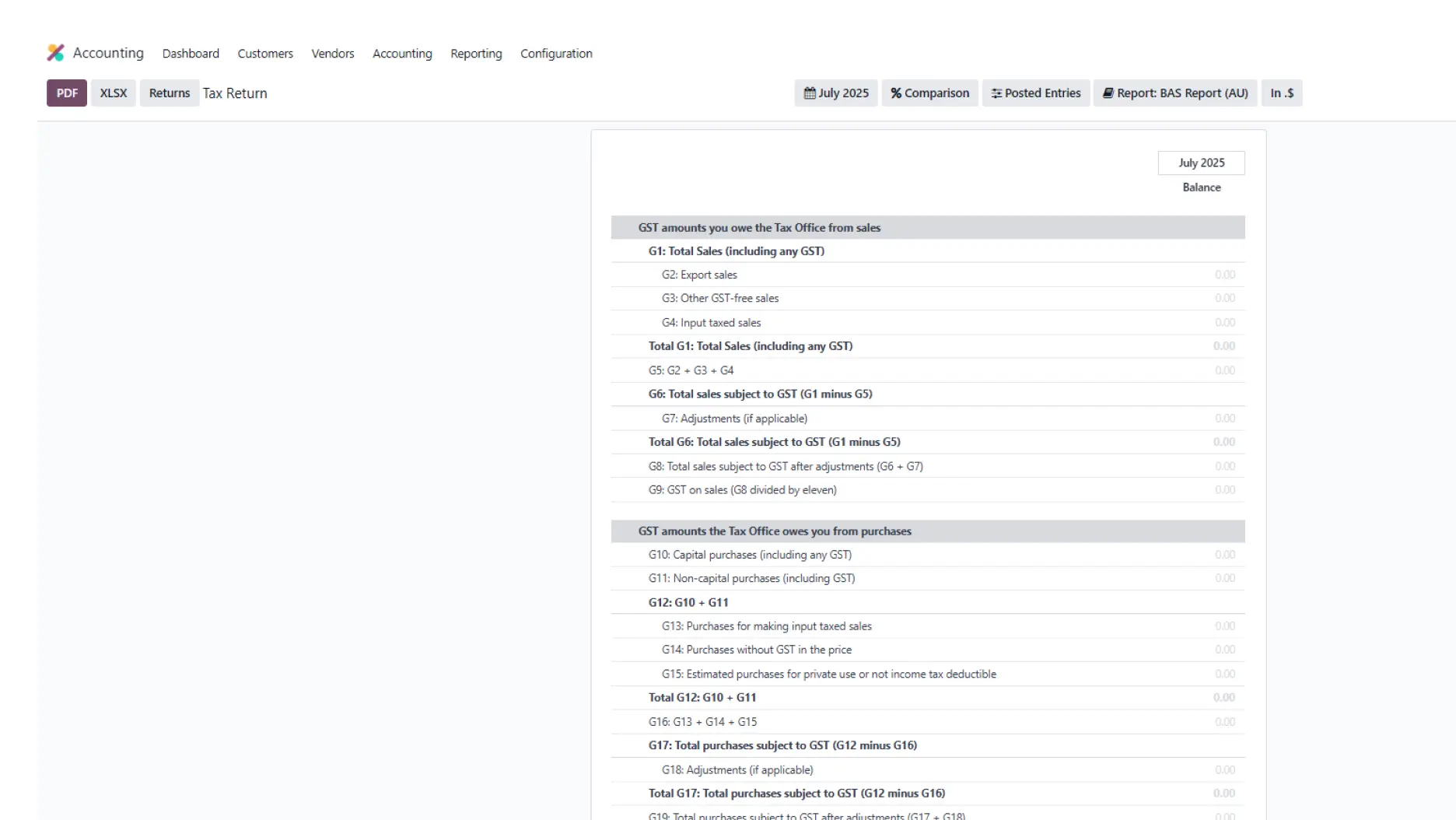

3. Automated ATO Compliance Reporting: BAS and TPAR

This is one of the most powerful features of the Australian localisation. The system comes with pre-built templates for the two most critical ATO reports for many businesses:

-

Business Activity Statement (BAS):

Odoo automatically populates the BAS report by tracking the GST amounts from your transactions throughout the reporting period (monthly or quarterly). At the end of the period, you can review a complete BAS report directly within Odoo before posting the closing entry, dramatically simplifying what is often a time-consuming and stressful process.

- Taxable Payments Annual Report (TPAR):

For businesses in industries like construction, Odoo includes the TPAR, used to report payments made to contractors. By correctly configuring fiscal positions for your subcontractors, Odoo captures the necessary data to generate this report, ensuring you meet your compliance obligations.

4. Streamlined Banking with ABA File Generation

The localisation package includes the ABA Credit Transfer module. This allows your finance team to generate payment files in the standard format required by all Australian banks. This is used for processing batch payments to multiple vendors or for payroll, saving significant time and reducing the risk of manual payment errors.

The Accountant's Perspective: Why Getting This Wrong Is Not an Option

A purely technical implementer might overlook the profound, long-term consequences of failing to install the correct localisation before a single transaction is entered. As accountants who have rescued failed projects, we know the damage it can cause.

If the localisation is not set up correctly from the start, you will face a cascade of critical issues:

- A Non-Compliant System:

You will be forced to manually create the entire Chart of Accounts and all tax rules, a minefield of potential errors that can lead to inaccurate reporting and ATO penalties. - The Nightmare of Inaccurate Tax Data:

Without the pre-configured tax mapping, your GST calculations will be unreliable, making your BAS report a work of fiction. The cost to clean up months or years of incorrect tax data is immense. -

Lack of Critical Reporting:

You will not have access to the automated BAS and TPAR reports, forcing your team back into a world of manual spreadsheets to meet your compliance deadlines. - Wasted Time and Money:

The cost of manually installing missing apps, reconfiguring the entire system, and correcting bad data will far exceed the cost of doing it right the first time. - Potential payroll configuration gaps:

This can cause compliance issues down the line.

Most importantly, Odoo is designed for data integrity. Once a fiscal localisation package has been applied and transactions have been confirmed, it cannot be changed. You are locked in. This is precisely why an accountant-led implementation is not a luxury, but a necessity to safeguard your investment and the financial health of your business.

Get Your Odoo Localisation Right the First Time

Your ERP system is only as strong as its financial foundation. Ensuring the Australian localisation is set up correctly from day one protects your business from compliance risks, inaccurate reporting, and expensive rework. Our accountant-led approach ensures Odoo is configured to meet ATO requirements, giving you confidence in every transaction. Speak to our experts today and secure the integrity of your financial data.

Avoid costly mistakes with an accountant-led ERP implementation.

The information and tips shared on this blog are meant to be used as learning and personal development tools as you launch, run and grow your business. While a good place to start, these articles should not take the place of personalised advice from professionals. As our lawyers would say: “All content on WAO’s blog is intended for informational purposes only. It should not be considered legal or financial advice.” Additionally, WAO is the legal copyright holder of all materials on the blog, and others cannot re-use or publish it without our written consent.